FinTech Investments First Half 2025

July 2025

This report is a detailed analysis on the key trends in FinTech investments in Singapore for the first half (1H) of 2025, with a deep dive for the second quarter (Q2 2025), including a comparison with selected global and regional peers (“coverage universe”).

For 1H 2025, total FinTech investments across our coverage universe increased by 61% or US$25 billion (B) to US$66B compared to 1H 2024. However, this was largely driven by a single transaction of Discover Financial Services - US$35.3B from the United States. When we exclude outliers, total investments increased by a more modest 11%.

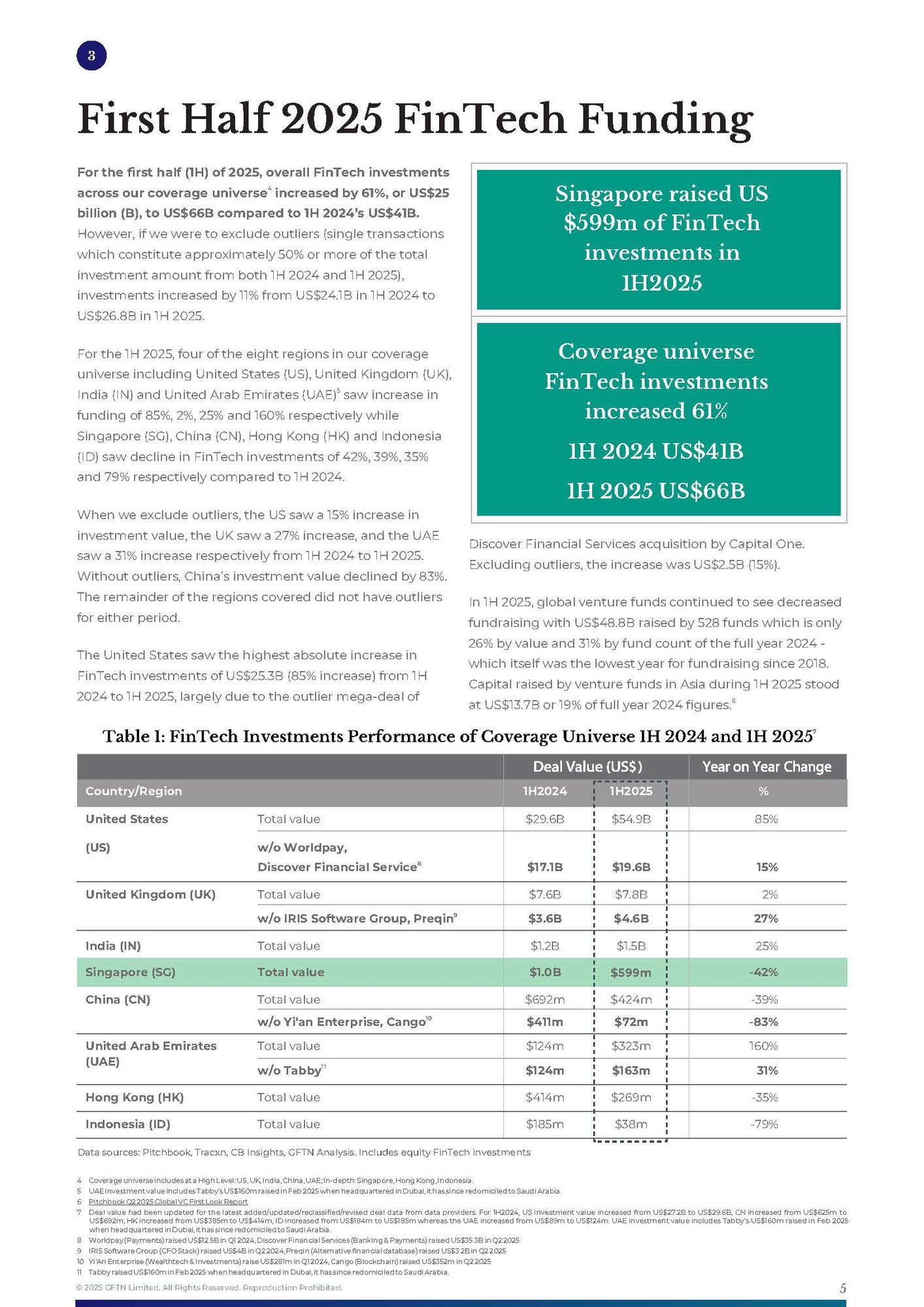

Singapore reported a total of US$599 million (m) in FinTech investments from 49 disclosed deals in 1H 2025, a decline of 42% year-on-year. Investments in China, Hong Kong, and Indonesia also faced reductions of 39%, 35%, and 79% respectively. In contrast, investments in major markets like the United States, United Kingdom, and India saw an increase of 85%, 2%, and 25% respectively, over the same period.

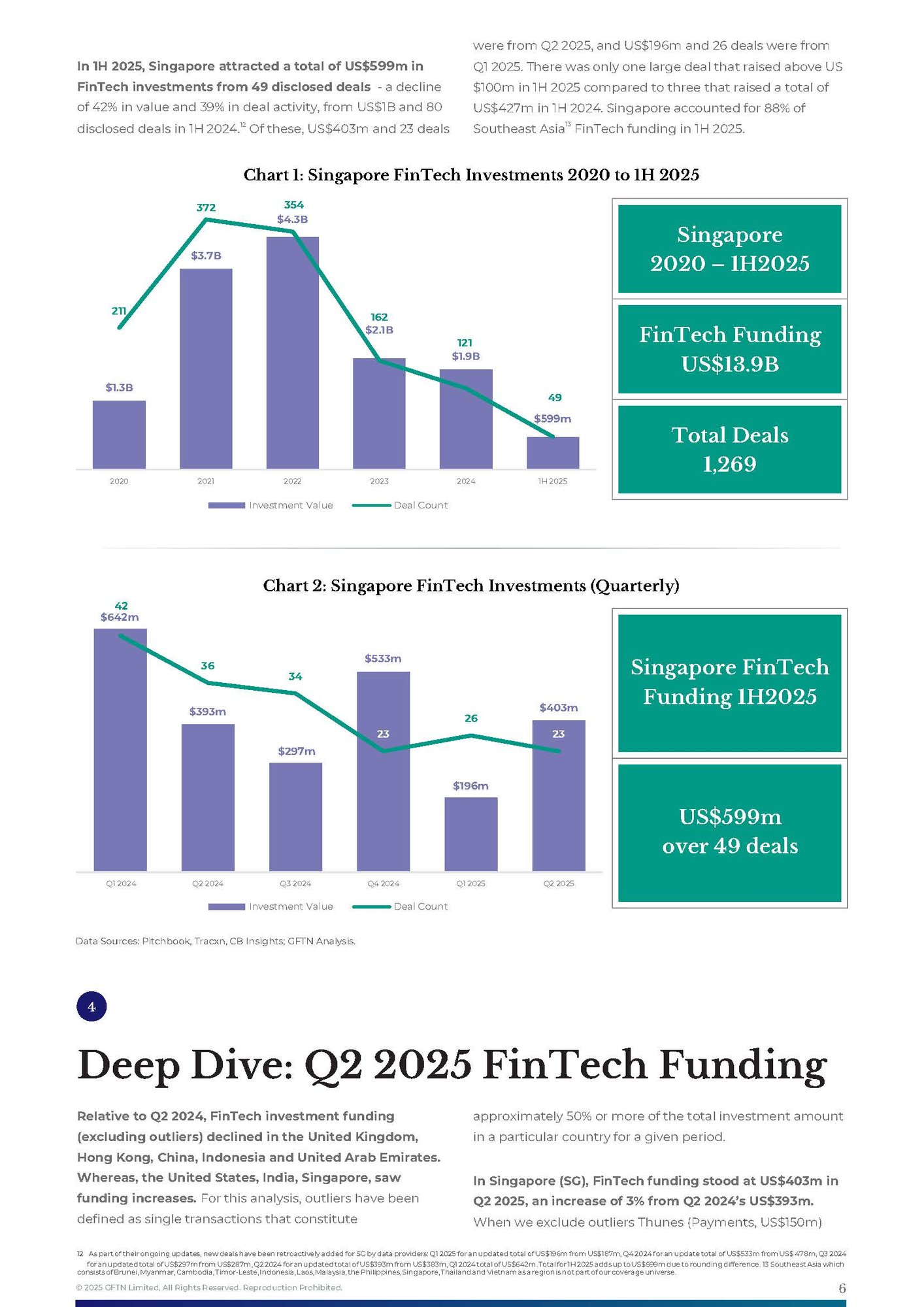

On a quarterly basis, in Q2 2025, Singapore's FinTech funding was US$403m, an increase of 3% from Q2 2024.

For this quarter, the key verticals driving investments included Payments at US$160m, followed by Wealthtech & Investments at US$56m and, Digital Assets at US$44m. The biggest transaction during this quarter in Singapore was Thunes (Payments) series D funding at US$150m.