Computational Regulation: A New Financial Supervision Model

Report of a roundtable discussion which took place during the Japan FinTech Festival 2024

October 2024

Fintech is here, bringing with it realised promises of market reach, innovation, and inclusivity. These advancements also come with novel and newly-magnified risks, such as opportunities for fraud and other misconduct. In principle, financial regulators and supervisors are tasked with identifying, monitoring, and mitigating the risks, in order to tip this balance in favour of the benefits.

In practice, however, we see divergent stories. Within the private sector, digitalisation is already changing the shape of the game for both commercial actors as well as fraudsters.

On the public sector side, however, this transformation lags; despite earnest efforts to adapt to the digital deluge, the continued prevalence of manual activity and legacy systems and processes combine to create lag, ultimately exacerbating the aforementioned risks.

An observer of this space may see this monumental effort as Sisyphean, particularly in the face of an increasing gauntlet of legislative constraints, misaligned data protection rules, and new areas of compliance requirements. These well-intentioned rules and frameworks are currently seen as limitations that inexorably result in tension and inefficiency between the regulatory, supervisory, and industry parties. But this doesn’t

have to be the case.

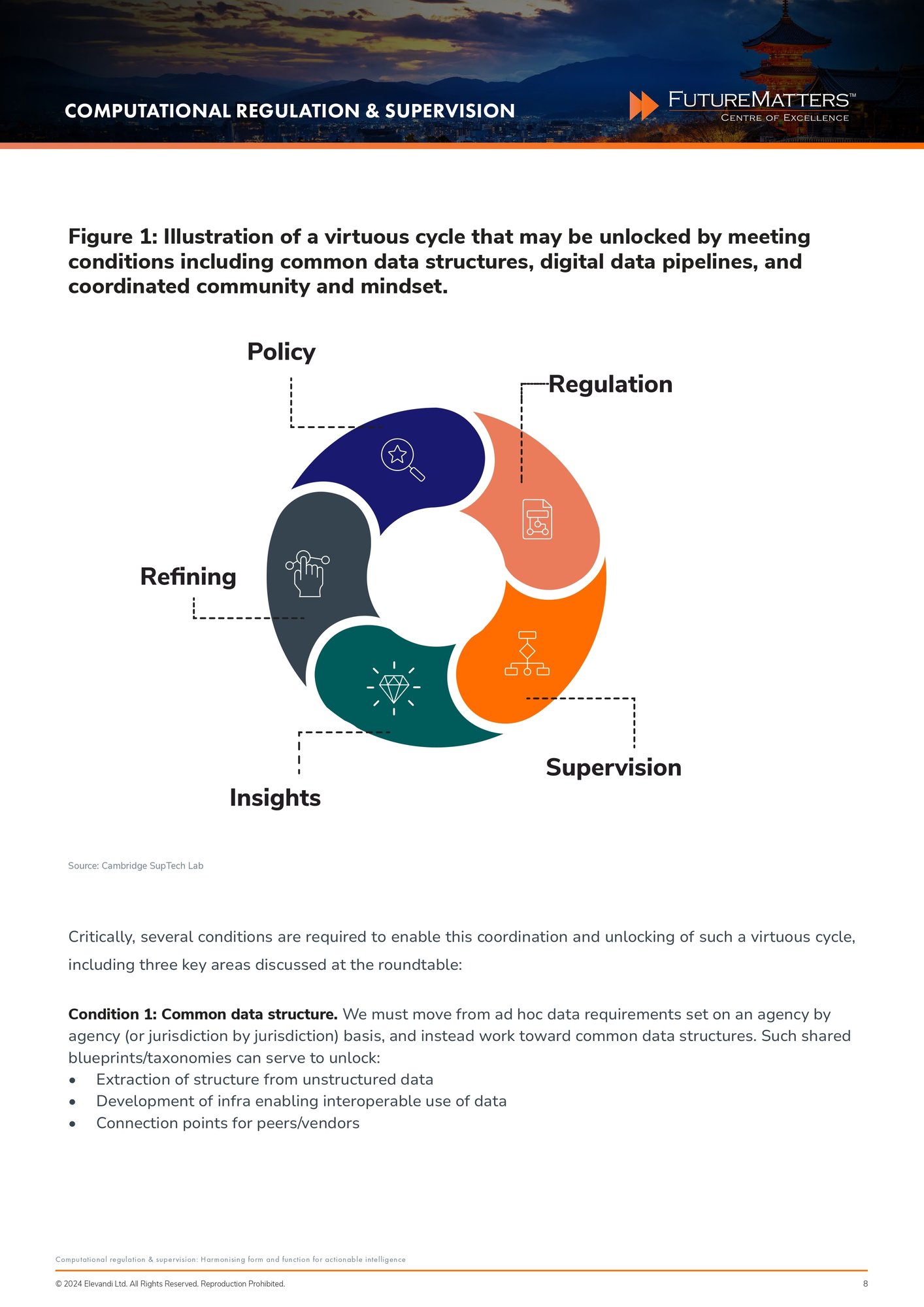

Our roundtable conversations, summarised below, lay out an opposite thesis. Protecting the stability and security of financial systems can mitigate these competing priorities, but requires coordination across these various efforts, and in fact, can form a virtuous cycle. Policymakers set obligations regarding reporting, regulators implement the rules for industry to follow and report against, supervisors collect data and translate to actionable intelligence, which in turn serve a dual purpose of enforcing the regulation and assessing the impact of policy.

The cycle then repeats by refining the policy and regulation, measuring via supervision, so on and so forth.

FutureMatters is a platform for thought leaders, practitioners, and industry players to share their insights on emerging opportunities and challenges in today's world. Apply to be a contributor here.