Use Of AI/ML In Financial Supervision By Central Banks

Written by Jean Fernandes, Group Chief Financial Officer, GXS Bank

This discussion paper delves into the dynamic realm of Artificial Intelligence (AI) / Machine Learning (ML) and its revolutionary impact on elevating regulatory supervision, particularly in the oversight of financial institutions.

Deployment of AI by supervisory agencies holds vast potential to propel supervision into a new era where predictive insights into economic, financial, and risk events become the norm. This transformative approach can deliver proactive surveillance of risk and compliance, fortify prudential oversight, and empower central banks with innovative tools to fulfil their monetary and macroprudential mandates. Several supervisory agencies are already at the forefront as they recognise that it's not just the advancements in AI tools but also the abundance of data that presents an unparalleled opportunity to dramatically enhance current supervisory methodologies or craft superior ones.

The sheer volume of data available to supervisors today creates opportunities for uncovering associations and elevating prediction accuracy. Central banks are now

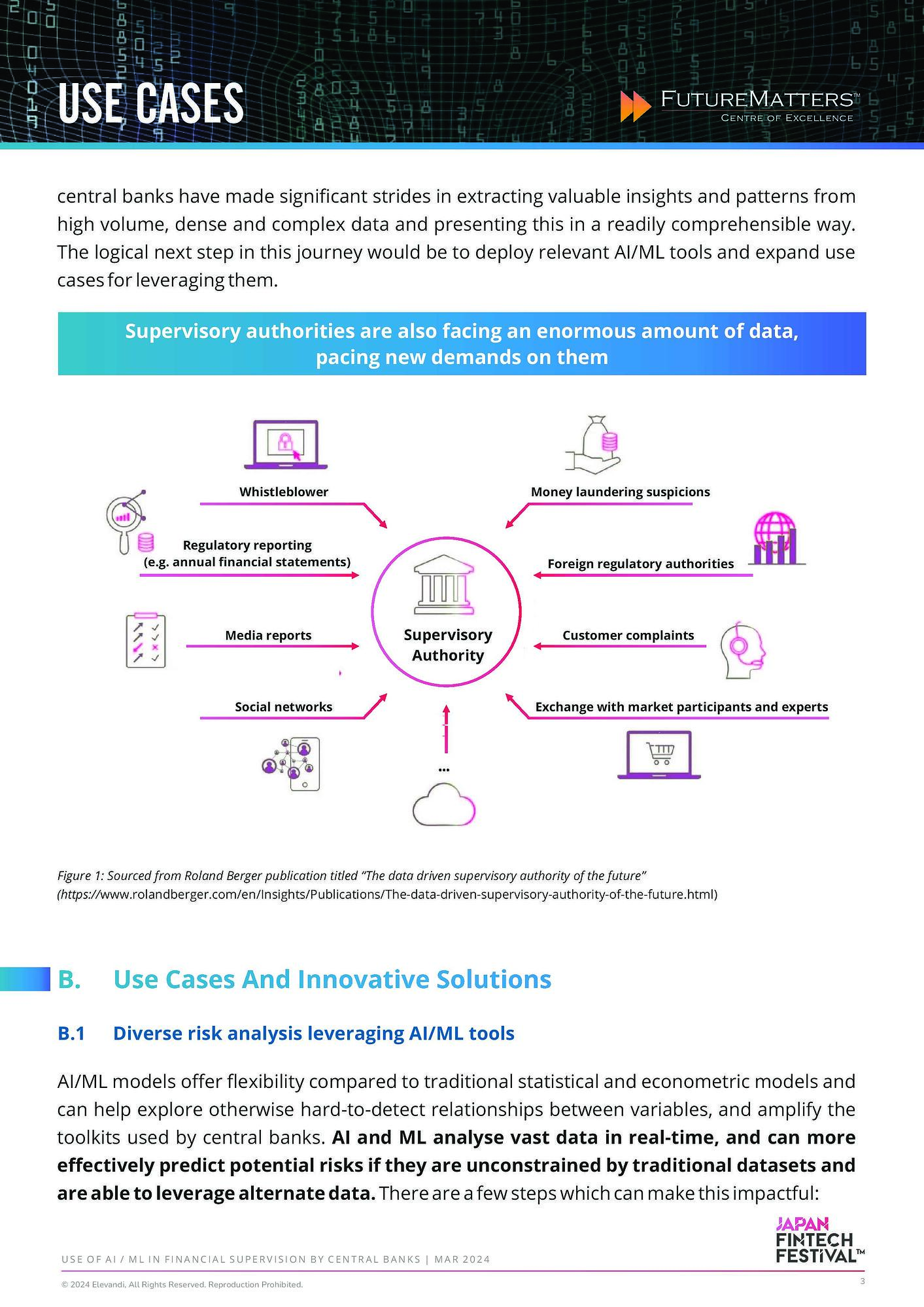

becoming adept at seamlessly acquiring large sets of data from supervised entities leveraging technological advancements for data collection. Additionally, by leveraging data analytics, central banks have made significant strides in extracting valuable insights and patterns from high volume, dense and complex data and presenting this in a readily comprehensible way. The logical next step in this journey would be to deploy relevant AI/ML tools and expand use cases for leveraging them.

FutureMatters is a platform for thought leaders, practitioners, and industry players to share their insights on emerging opportunities and challenges in today's world. Apply to be a contributor here.