WHAT WE DO

We Build Sustainable Financial Ecosystems

How We Deliver Value

Connections

Challenge:

Fragmented ecosystems across geographies, between public and private sectors and among some stakeholders who rarely work together limits cross-border collaboration and regulatory alignment.

Solution:

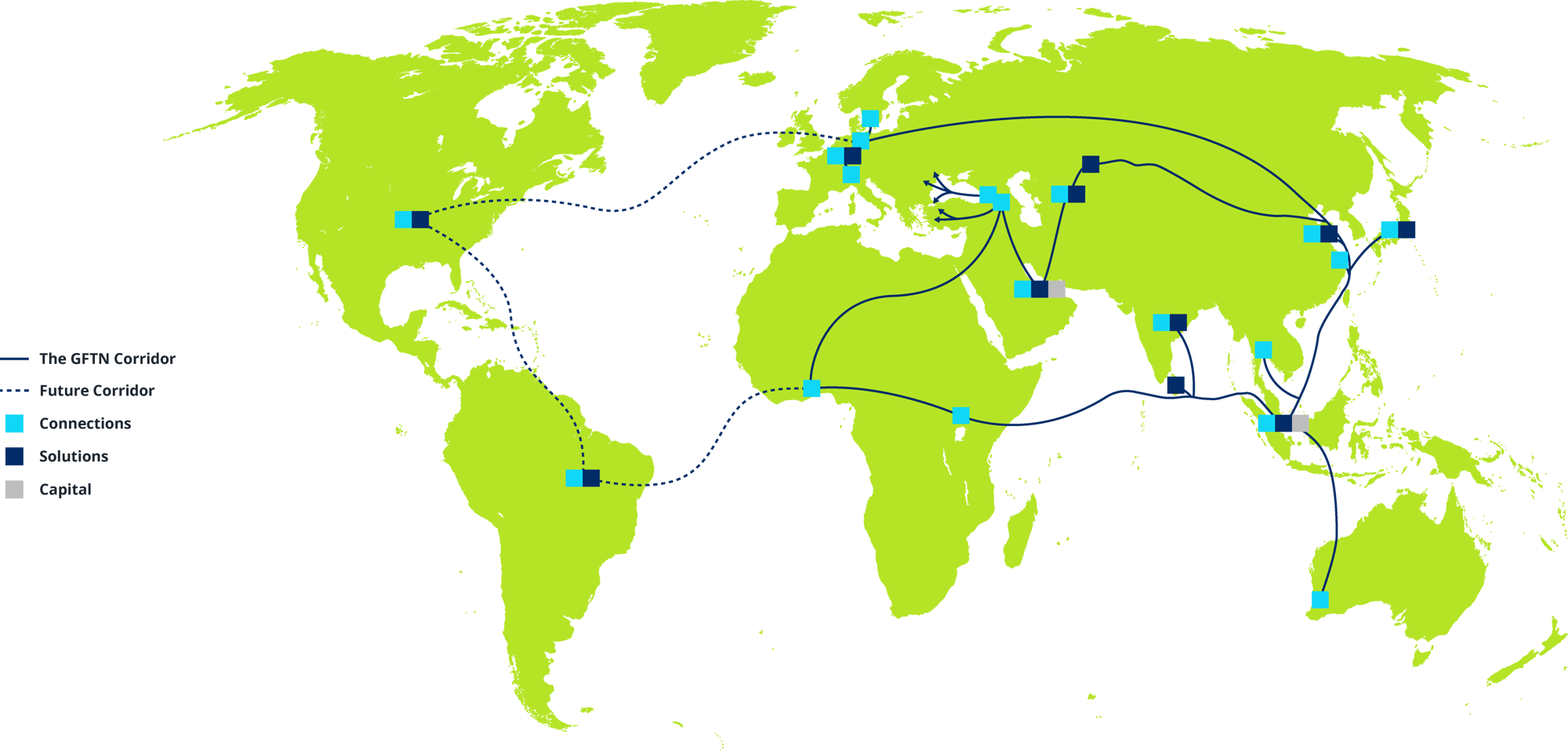

We convene flagship forums across Asia, Europe, Africa creating trusted spaces where regulators, institutions, corporate and tech leaders define the next decade of transformation, learn from each other, forge partnerships and unlock growth corridors.

Solutions

Challenge:

Governments are building the expertise to design effective policies and build infrastructure and talent capacity for FinTech. Corporates struggle to navigate regulatory landscapes.

Solution:

We draw on Singapore’s proven FinTech experience and innovation ecosystem. We partner with governments and corporates to shape policy, develop ecosystems and enable market entry through practitioner-led advisory and capacity building.

Capital

Challenge:

High-growth fintechs may lack capital and strategic networks to scale.

Solution:

To provide capital combined with access to our global network of and institutions. Subject to regulatory approvals, we will support growth-stage enterprises with capital and strategic networks for sustainable growth.

Who We Serve

Financial Institutions & Corporates

Access global networks, trusted dialogue, and strategic partnerships that build operational resilience. Navigate disruption and capture emerging market opportunities through regulatory insight and cross-border collaboration.

Central Banks & Regulators

FinTechs & Entrepreneurs

Investors

Academia & Knowledge Partners

What We Can Offer You

Impact in Action

Our partnerships are built on deep collaboration, bringing together the right stakeholders, technical expertise and resources to address specific challenges. From policy frameworks and capacity building to market access and ecosystem development, we create lasting value through sustained engagement and practical implementation.

Building Odisha's FinTech Hub, India

Banking Circle: Driving Asia-Pacific Expansion through Strategic Engagement

Africa's Next Gen DPI: Harmonising Digital Payments Across Africa

Get the latest news and insights shaping the future of finance, delivered to your inbox.

Newsletter sign up

By submitting, you agree to receive email communications from GFTN Services Pte Ltd and its affiliated brands, including upcoming promotions, tickets, news and access to exclusive invite-only events.