Bridging the FinTech Skill Gap with the SHIME Framework: Solving the Talent Issue

Written by CFTE co-founder Tram Anh Nguyen

What are the reasons behind the skills gap?

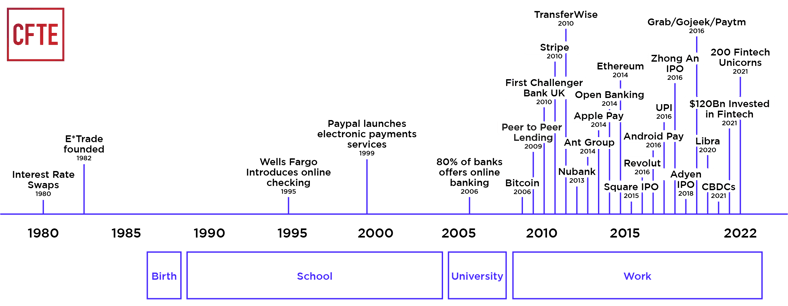

In the 2000s, finance was seen as a large industry that was largely immune to the disruptions that other industries - such as travel, advertising or retail - were facing because of technology. Then after the 2008 subprime crisis, it saw exponential growth in the number of innovative milestones, from the first Bitcoin mined to $120Bn being invested in FinTech in 2022 (Figure 1). Covid was a major catalyst for the transformation, with 63% of consumers worldwide now using FinTech services. As a result, 5 out of 10 biggest financial services providers today are platform-based.

Because of these innovations, new players emerged, new activities were created, old roles were transformed or disappeared, and new roles appeared. New skills are therefore required to understand this new world.

Figure 1. Acceleration of the Developments in Finance

However, even professionals in their early 30s might find it difficult to understand these changes. A 35-year old, born in 1987, would have left university around 2010, at exactly the same time when all these changes started to happen. All these new industry trends (from Open Banking to Digital Assets to Challenger Banks or Digital Payments) which affect all sectors of payments happened after that professional left school. This avalanche of new knowledge that happened during the work life of this 35-year old demonstrates the need for a system for Adult Education.

“In a changing environment, there is a widening skills gap for those who cannot adapt to the new digital world. Identifying the skills gap in financial services to develop digital-resilient and a future-enabled workforce is a priority for governments. But how can governments, regulators and other policy-makers be at the core of this progress?” - Tram Anh Nguyen

To give you a big picture of what is happening: our education systems have been built on learning hard skills. It takes years for a person to learn hard skills to reach the level of a machine. Hard Skills are important but are not sufficient in today’s industry. Everyone needs a combination of skills to thrive in the industry, which is why CFTE created the SHIME framework.

The SHIME Framework

The qualitative tool, SHIME, includes different capabilities in five aspects: soft skills, hard skills, industry knowledge, mindset and experience. While it is no doubt that hard skills such as programming and data analysis are essential in FinTech, soft skills and mindset are also the priority for companies to choose a suitable candidate.

Figure 2. SHIME FinTech Skills Framework

The key to success in FinTech is acquiring the abilities required in the position while expanding the knowledge base in different sectors and cultivating right mindsets and soft skills. Adopting the SHIME framework can identify the ideal profile for FinTech employers, and determine the skills crucial to employment or career development for individuals. SHIME spawns advantages for different stakeholders of the digital finance industry (Figure 3).

Figure 3. Benefits of SHIME

Although the framework helps, the professionals need to determine what skills they have acquired so far. Therefore, CFTE developed the SHIME FinTech assessment, which is built on the elements of the SHIME framework. The aim of CFTE is to provide a thorough process for individuals to evaluate their competencies to ultimately upskill into the jobs of the future. Moreover, considering the bigger picture - SHIME can be utilised by governments to analyse the workforce and its readiness to implement a country’s digital economy strategy.

So how can policymakers bridge the FinTech skill gap? For one, governments can lead the line in creating programmes aligned with the required skills of the workforce. We believe that adult education, retraining, upskilling and reskilling should be at the centre of the conversation. Through these approaches, individuals can enhance their adaptability to the digital era and fast-changing industry. So far, CFTE collaborated with the industry by performing a SHIME skill analysis of the workforce at large and by creating bespoke learning programmes to aid FinTech development locally. To find out more about the SHIME framework and do your own assessment, do join here.

FinTech Skills Discussion at Singapore FinTech Festival

The issue of the tech skill gap was discussed at a roundtable chaired by CFTE at the Singapore FinTech Festival in 2022 at the Elevandi Insights Forum. The meeting addressed the FinTech skill gap and the effectiveness of SHIME from the perspective of policymakers and organisations. As a result, observations construed a report, “The New Skills in Financial Services”, which discusses the tech skill gap, its causes and effects, as well as how adult education can provide a long-term solution for all tech stakeholders. The report can be accessed here.

This year, I have the pleasure to host the Talent Stage of the Singapore FinTech Festival 2023, where we will dive deeper into the concept of FinTech talent. This is an opportunity to get a first-hand perspective from the industry-leading panellists in addressing the importance of tech talent development. The purpose of Talent Stage is to help participants understand the skills that will be in high demand in the future economy, and how they can adapt and thrive in this new landscape.

The Talent Zone aims to create impact by building a talent pipeline for finance and FinTech, promoting lifelong learning in a VUCA landscape and strengthening gender diversity in the workplace.

To learn more about CFTE - visit our SFF page.